One topped S&P 500 in industry rarity.

DALLAS — This story was originally published by our content partners at the Dallas Business Journal. You can read the original version here.

2024 was a turbulent year for the stock market, between interest rate changes, the shifting winds of artificial intelligence and a presidential election.

But overall, the market experienced significant gains, with the S&P 500 surging 23.31% last year — its second consecutive annual increase exceeding 20% for the first time since the 1990s. The Nasdaq showed a 28.64% gain and the Dow Jones Industrial Average rose 12.88%.

That was despite a down December, reflecting investors’ caution around big changes in 2025, including uncertainty about rates and the plans of the new presidential administration.

Dallas-Fort Worth had quite a few stock market standouts last year, led by Irving-based Vistra Corp. Irving-based Vista (NYSE: VST) saw its shares increase 262.1% from a Jan. 2, 2024, opening price of $38.07 to a Dec. 30, 2024, closing price of $137.87.

It was the first utility stock to lead the S&P 500 — which it joined in May — in annual growth since 2001, according to Bloomberg . The company’s financials soared as the growth of AI and data centers led to higher demand for power.

Below: A screenshot of Vistra’s stock performance in 2024, from Yahoo Finance.

Brinker International Inc. — owner of restaurant chains Chili’s Grill & Bar and Maggiano’s Little Italty — was the only other North Texas company to see its stock value rise by more than 200% at 214.5%.

The momentum has continued into the new year. Coppell-based Brinker (NYSE: EAT) hit a 52-week high on Jan. 2.

Below: A screenshot of Brinker’s stock performance in 2024, from Yahoo Finance.

United States Lime & Minerals Inc. (Nasdaq: USLM) also had a strong 2024 on the stock market. The Dallas-based limestone manufacturer saw a 188.6% increase in share value during the year.

Though the construction sector faced challenges in 2024 due to slowing demand tied to high production costs, limestone continued to rise. United States Lime & Minerals stock touts a 656% total return over the last five years according to Simply Wall Street.

Below: A screenshot of United States Lime’s stock performance in 2024, from Yahoo Finance.

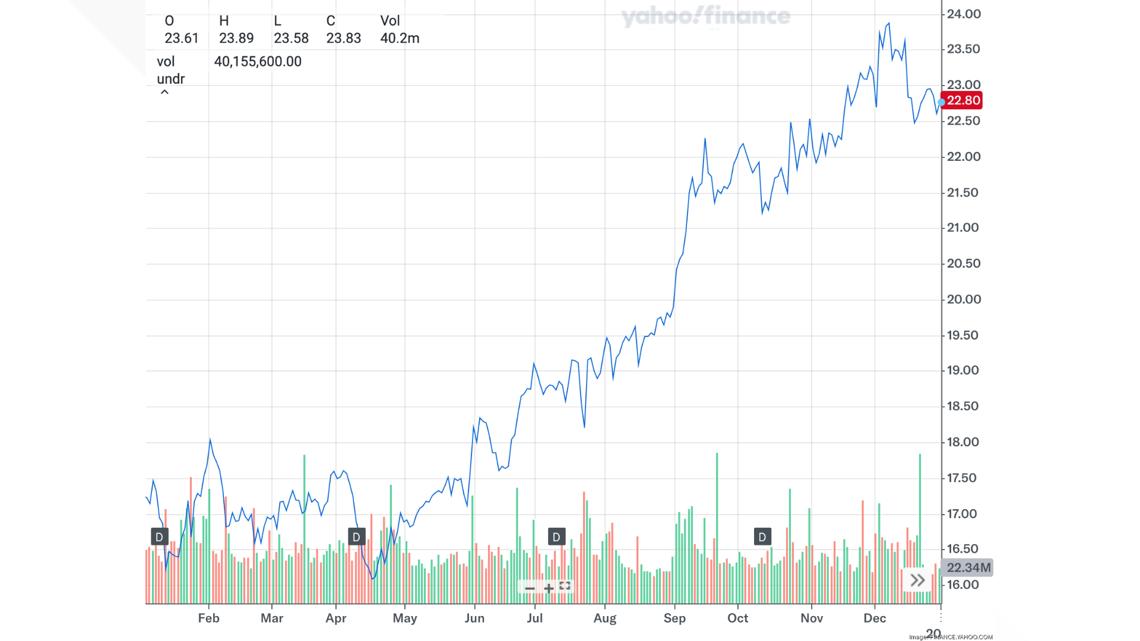

While it wasn’t among the top gainers, AT&T Inc. (NYSE: T) had a significant year on the stock market. The Dallas-based telecommunications company saw its share price climb 32%, giving it a market capitalization of around $160 billion. In early December, AT&T announced a plan to return more than $40 billion to shareholders through dividends and share repurchases in the next three years. Following the announcement, the telecommunications company’s stock rose to its highest level in three years, hitting $24.

Below: A screenshot of AT&T’s stock performance in 2024, from Yahoo Finance.

Here’s a quick look at how a few other stocks from the region performed.

- Sonida Senior Living Inc. (NYSE: SNDA) — The Dallas-based senior living communities and assisted living operator stock price rose 159.3% last year to $23.08

- Southwest Airlines Co. (NYSE: LUV) — The Dallas-based airline’s shares have risen 18% to $33.62

- Energy Transfer LP (NYSE: ET) — The Dallas-based oil and gas giant’s shares have risen 41.1% to $19.59.

- Solidion Technology Inc. (Nasdaq: STI) — The Dallas-based battery manufacturing company’s stock price fell 90% to $0.70.

- Instil Bio Inc. (Nasdaq: TIL) — The Dallas-based biopharmaceutical company’s shares have risen 145.7% to $19.09

- CBRE Group Inc. (NYSE: CBRE) — The Dallas-based real estate and investment firm’s stock price rose 40.8% to $131.29.

- McKesson Corp. (NYSE: MCK) — The Irving-based pharmaceutical company’s shares rose 20.4% to $569.91.

- American Airlines Group Inc. (Nasdaq: AAL) — The Fort Worth-based airline’s stock price rose 29.7% to $17.43.